Recent Case Studies

Reach out to The Wealth Engineers to secure your next investment property

Touted by an expert panel as one of the top 50 suburbs in Australia for investment property, we secured this off market gem for our clients.

This couple is onto the 3rd property in their portfolio. High demand in this suburb, low days on market & everyone wants a piece of land here. We recently had a comparable (but still inferior) property in the area selling for over $30k than this one, with 4-5 serious buyers.

With great cashflow in today’s environment, this property ticked all the boxes.

This property ticked all the boxes for my client. On budget, high growth area with plenty of prospective infrastructure, jobs earmarked by the government.

A very highly contested area with large demand which are good signs for capital growth.

This 680m2 property with existing tenants was the first property for our client. There is scope to potentially add another bedroom to create uplift in the property without spending much and then use equity to go again.

We are delighted to have secured this property in a booming area for this awesome couple. This is their 3rd property in their portfolio and are killing it!

The purchase fit the clients budget and given constructions costs, we effectively bought the land for free at this price.

Comparable properties are selling well over $20-30k above the purchase price, coupled with a fantastic yield, this couple can sit back, relax and watch it grow!

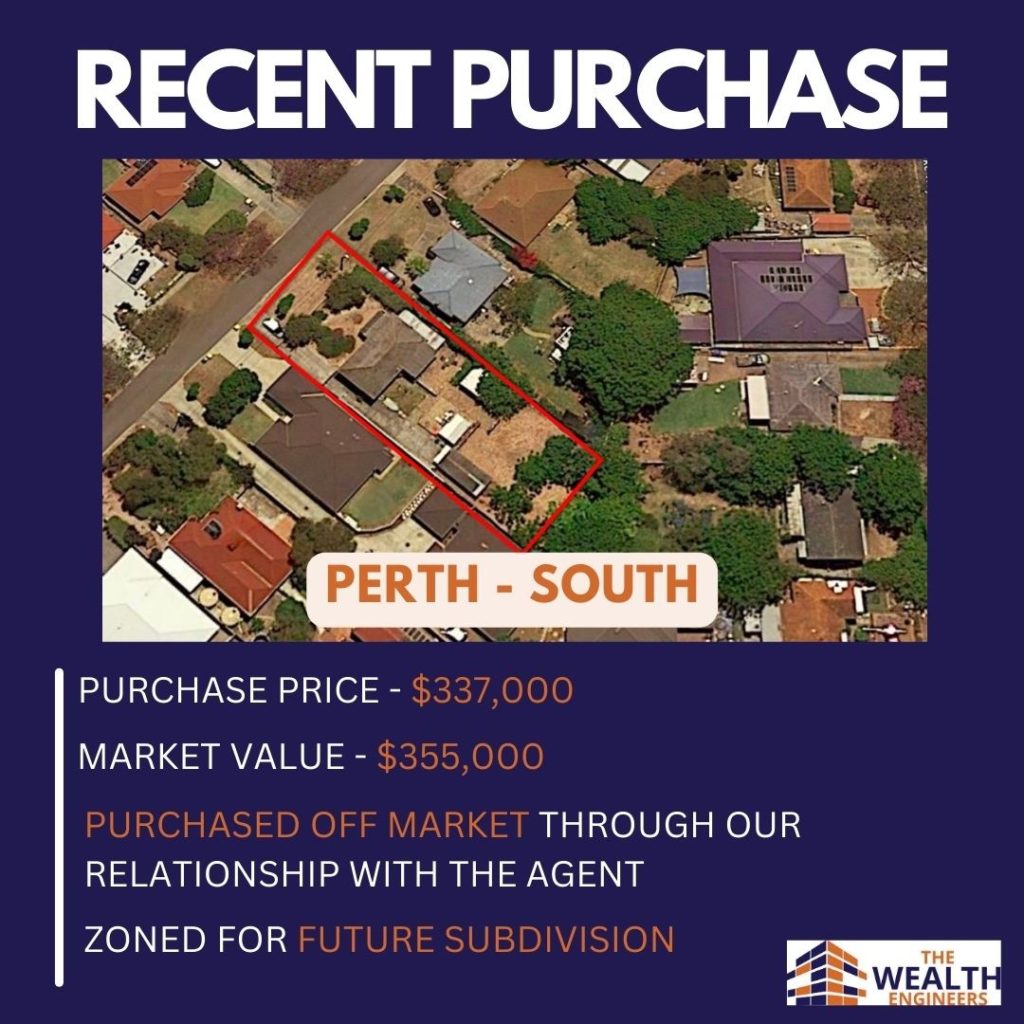

We recently secured this property off market for our clients through our fantastic real estate agent relationship.

This 728m2 property was secured well under market value and has the room for renovation to increase capital growth and rental income.

A 30 minute drive to the CBD on a good day and close to various beaches, this one was a gem!

Our client required a property investment with strong cashflow & sound capital growth.

We focused on a large regional centre in Queensland for this purchase. The area is showing strong employment, incomes and demand factors, fundamental to capital growth.

We have already seen uplift in this area and strong rental demand for our client.

Our client has recently secured this solid investment property in Perth through TWE. We secured this property despite the high local/interstate demand through our previous agent relationship.

This property in on a >700m2 block, 30 minute drive to Perth CBD and 5 min drive to pristine white sand beaches.

Prior to TWE, we purchased this commercial retail tenancy in early 2022. The owner was in a distressed position during Covid and therefore was able to pick this up with a $25k discount.

It is one of our cashflow piggy banks giving balance to the portfolio. There is a lot to commercial property investments with higher risks but better cashflow than residential property.

TWE bought this property in 2019 in the northern suburbs of Brisbane using our data metric analysis and has seen an average of over 40% capital growth whilst catching the Brisbane boom

Rental growth has also increased significantly which is now yielding 6.5% from the original purchase price and will likely increase again this year.

It’s amazing what results can be achieved in under 3 years! We purchased this standalone house in the SE Qld market prior to the Brisbane boom, and have achieved almost a 70% cap growth and 30% rental increase over the past 2 years.

The rental income now pays the house down without any further out of pocket expenses.

Recent purchase of this outstanding property in a highly sought after area in the south of Perth. This area which is going through gentrification is experiencing some serious rental demand at 5.5% yield. Vacancy rates are <0.5%.

Future potential STCA to add another dwelling based on the land size of over 900m2. This property has increased by 20% over the past year.